Regular Individual Giving

Every donation to the Irish Heritage Trust helps us safeguard and preserve Irish Heritage – not just for today, but for generations to come.

We ask you to consider becoming an Irish Heritage Pioneer. Pioneers support the work of the Trust by helping us increase access to the heritage properties we care for. We do this by developing engaging visitor experiences and through imaginative outreach programmes and partnerships.

Becoming an Irish Heritage Pioneer is more than just donating money – it is an investment in who we are and where we come from. We all have a role in minding the stories, places and traditions that make us who we are today.

Irish Heritage Pioneers demonstrate their support by donating €25 a month to the areas of greatest need at the Trust. With your support we can develop new ways of sharing and preserving Irish Heritage.

Become an Irish Heritage Pioneer Today

The Trust’s Greatest Need Fund allows us to respond swiftly and flexibly to acute need. All donations to the Fund are unrestricted to enable the Trust allocate funds to have the greatest impact. This kind of philanthropic support is a salute to the past. It is an investment in the work that needs to be done today and tomorrow. With everyone doing a bit for Irish Heritage we can be sure that together we can do great things!

The Impact of Your Support

1. Keep important Irish historical, cultural and natural assets open for the enjoyment of all.

2. Restore and develop the biodiversity of Ireland’s wonderful outdoor spaces.

3. Create opportunities and resources for local communities, as well as exceptional, welcoming visitor experiences.

Make a Once-off Donation to Support Our Work?

If you would like to make a once-off donation in support of the work of the Irish Heritage Trust, or to support a specific Irish Heritage Trust property, you may do so by clicking on the button below.

“The Trust’s Greatest Need Fund allows us to respond swiftly and flexibly to acute need. This ability to respond to changing circumstances and emerging opportunities makes this fund so important to our work. As all donations to the Greatest Need Fund are unrestricted it equips the Trust with the flexibility and agility to allocate these funds where it can have the greatest philanthropic impact.”

Anne O’Donoghue – CEO of the Irish Heritage Trust

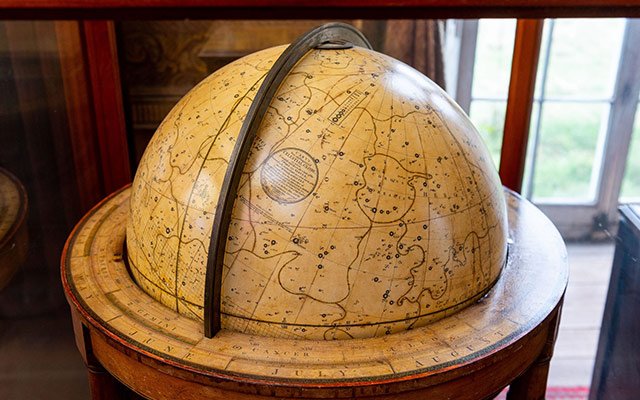

Our Properties

We manage and care for Fota House, Arboretum & Gardens, Johnstown Castle Estate & Gardens, and Strokestown Park House & Gardens, as well as the National Famine Museum, the Irish Agricultural Museum.

Thanks to the generosity of Fingal County Council, we are thrilled to be establishing a significant new cultural hub at No.11 Parnell Square East in Dublin. No.11 The Home Of Poetry and Heritage will be a cultural and heritage space shared by Poetry Ireland, The Irish Heritage Trust and the Irish Landmark Trust.

Tax Efficient Giving

If you are an Irish taxpayer and donate more than €250 to the Irish Heritage Trust in any year you may increase the value of your gift to the Trust by 44.9%. The Government approved tax back scheme can be availed of by signing and completing the attached CHY3 Enduring Certificate and returning it to the Irish Heritage Trust.

There is no cost to you and the Trust will then reclaim the tax paid on your donation on your behalf from the Revenue Commissioners. All you need to do is to complete the CHY 3 Form and post it to:

Finance Department

Irish Heritage Trust

11 Parnell Square

Dublin 1

D01 ND60

Your Certificate is then valid for 5 years, but it can be cancelled by you at any time.

The impact of this Certificate is considerable and makes a real difference. For example, should you donate €250, the Trust may claim an additional €112.32 in tax back. This increases the true value of your €250 gift to €362.32!

If a company makes a donation of over €250 in the year, the company can claim a tax deduction as if the donation was a trading expense.

There is a four-year time limit for making a claim under this scheme.

Further information from Revenue on the Charitable Donation Scheme can be found here.

Donating from Overseas?

If you would like to support the Irish Heritage Trust from overseas, please contact us.

Depending on your location, tax effective giving may be available to you.

Governance

The Irish Heritage Trust is an independent registered charity governed by a voluntary Board of Trustees and guided by the Code of Good Practice for Good Governance of Community, Voluntary and Charitable Organisations in Ireland.

Charity Regulatory Authority Number: 20061609

Revenue Charity Number: 16848

VAT Number: 9571484R

Company Registration Office Number: 422959

Contact the Irish Heritage Trust Philanthropy Department

If you would like to talk to us about philanthropy, finance or governance at the Irish Heritage Trust, please contact us below:

Philanthropy

Governance

Daniel Stanford, Deputy Company Secretary

secretary@irishheritagetrust.ie

Finance

Ciaran Griffith, Finance Officer

finance@irisheritagetrust.ie