Together we are creating a vibrant, sustainable future for Irish heritage.

When you give to the Irish Heritage Trust, you help us to carry out vital conservation work at the properties we care for. This support underpins our education and outreach work, preserving built and living history for future generations and benefiting local communities and Ireland as a whole.

Give to Our Properties

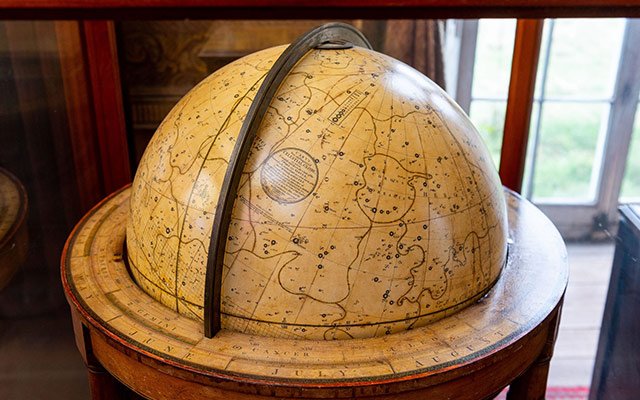

We manage and care for Fota House, Arboretum & Gardens, Johnstown Castle Estate, Museum & Gardens and The National Famine Museum | Strokestown Park, as well as our headquarters at 11 Parnell Square East which is also an historic building in the heart of Georgian Dublin. We do this on the behalf of the people of Ireland on a non-profit basis.

Supporting Our Work

Membership, visits and volunteer time all help us look after these very special heritage places. As a charity we simply couldn’t do it without you and donations play a vital part.

Direct donations, bequests, corporate donations and partnerships, are an important part in funding our work as Ireland’s designated heritage management body. Thanks to you, we are able to open up some of Ireland’s most prestigious houses and gardens to the public and take on ambitious projects to help conserve and share diverse aspects of Irish heritage and culture in engaging ways.

How to Join Others and Give to the Irish Heritage Trust

Individual Giving

Individual giving has real impact on the work of the Irish Heritage Trust. Your donation will have a terrific impact on the work we do. You can choose which area you would like to support and for how much. Donors can elect to make a one-off donation or a regular gift.

Leave a Lasting Legacy

When you make a bequest to the Irish Heritage Trust, you are also honouring the past and making a gift to future generations.

Dedicate Your Donation

If you would like to leave a gift in your will to the Irish Heritage Trust, you can choose to dedicate your bequest to a specific project or project type.

For further information email: donorrelations@irishheritagetrust.ie

Tax Efficient Giving

If you are an Irish taxpayer and donate more than €250 to the Irish Heritage Trust in any year you may increase the value of your gift to the Trust by 44.9%. The Government approved tax back scheme can be availed of by signing and completing the attached CHY3 Enduring Certificate and returning it to the Irish Heritage Trust.

There is no cost to you and the Trust will then reclaim the tax paid on your donation on your behalf from the Revenue Commissioners. All you need to do is to complete the CHY 3 Form and post it to:

Finance Department

Irish Heritage Trust

11 Parnell Square

Dublin 1

D01 ND60

Your Certificate is then valid for 5 years – it can, of course, be cancelled by you at any time.

The impact of this Certificate is considerable and makes a real difference. For example, should you donate €250 the Trust may claim an additional €112.32 in tax back, meaning the true value of your €250 gift is increased to €362.32.

If a company makes a donation of over €250 in the year, the company can claim a tax deduction as if the donation was a trading expense.

There is a four-year time limit for making a claim under this scheme.

Further information from Revenue on the Charitable Donation Scheme can be found here.

Donating from Overseas?

If you would like to support the Irish Heritage Trust from overseas, please contact

Depending on your location, tax effective giving may be available to you.

Our Commitment to Transparent and Accountable Fundraising

Donor Charter

Our Donor Charter reaffirms our commitment to the standards outlined in the Charities Governance Code and the Guidelines for Charitable Organisation of Fundraising from the Public. We also comply with other relevant legislation which covers data protection, health and safety and our obligations as an employer. In addition, our loans, donations and bequests are all received in accordance with our Museum Standards Policy.

Our Fundraising Complaints Procedure

We take complaints seriously and you can download our comprehensive Fundraising Complaints Policy.

Other Important Documents

Click to download the following documents:

Governance

The Irish Heritage Trust is an independent registered charity governed by a voluntary Board of Trustees and guided by the Code of Good Practice for Good Governance of Community, Voluntary and Charitable Organisations in Ireland.

Charity Regulatory Authority Number: 20061609

Revenue Charity Number: 16848

VAT Number: 9571484R

Company Registration Office Number: 422959

Contact the Irish Heritage Trust Philanthropy Department

If you would like to talk to us about philanthropy, finance or governance at the Irish Heritage Trust, contact our team.

Philanthropy

Governance

Daniel Stanford, Deputy Company Secretary

secretary@irishheritagetrust.ie

Finance

Ciaran Griffith, Finance Officer

finance@irisheritagetrust.ie

Donations & Data Enquiries

Get Involved

Donate Now

Support our work to bring some of Ireland’s most precious historic houses, gardens and histories back to life.

Step back in time and visit an Irish Heritage Trust property – Proudly a Work in Progress.